The impact of the COVID-19 outbreak on the healthcare industry

Disclaimer: This post was written a time ago, so some details may have changed since then. We advise you to check out our services page for more information or to contact us directly through this form. Thanks!

COVID-19 outbreak is still a major shock for economies and healthcare systems around the world and constitutes a real game-changer for the investment in the health sector.

This situation is a challenge for the economies since the global income could be USD 7 trillion lower by the end of 2021 than what the OECD expected in November 2019. Despite the continuous efforts made by the European Union to avoid the negative effects of the pandemic situation, the health costs derived from the COVID-19 has accounted for almost a fifth of OECD public spending.

However, every crisis can be a great chance to transform ourselves and reformulate our current state. Despite all the negative consequences of the COVID-19, this situation can be taken as a starting point to generate new opportunities.

A paradigm shift: COVID-19 can reshape the future of the health sector and generate new opportunities

Although the healthcare system is directly affected by the COVID-19, it has not been passive. This sector has learned how to tear down all those barriers found.

What is happening with the biotechnology industry?

Biotech and pharma industries are more than ever on the spotlight to overcome this pandemic situation. As a consequence of the lockdown, some companies such as Merck were expected to lose up to USD 2 million during 2020.

Regarding the Coronavirus Vaccine Tracker, there are more than 60 COVID-19 vaccine candidates under clinical trials: 37 of them are under phase 1, 27 in phase 2, 20 in phase 3, 6 candidates have been approved for limited use in certain countries and 4 for general use. The authorised vaccines in the EU and US are the Comirnaty® vaccine from Pfizer-BioNTech and the COVID-19 Vaccine Moderna, moreover AstraZeneca vaccine has been recently authorised across the EU.

Furthermore, other advanced and promising candidate vaccines are being developed from different technical approaches and by pharmaceutical or biotechnology companies from all over the world. The need and urgency of the vaccine are pushing governments to invest a large amount of money to acquire doses and develop clinical trials and production processes. A clear example is found in the United States government’s financing to the North American biotechnology company Novavax for the development of its vaccine against the coronavirus.

GENE THERAPY

| COMPANY | CANDIDATE VACCINE | PHASE | REQUIRED DOSES | ADDITIONAL INFORMATION |

|---|---|---|---|---|

| COMIRNATY ®. RNA based vaccine (BNT162b1) that codifies for a domain of a target cell binding protein from SARS-COV2. | Phase 3 | 2 doses | It is approved for general vaccination in US, UE, UK, Israel, Mexico, Unit Arab Emirates and Canada amongst others. Pfizer and BioNTech expect to produce 1,3 billion of doses by the end of 2021 at global level. |

| RNA based vaccine (mRNA-1273). | Phase 3 | 2 doses | It is approved for general vaccination in the US, UE, UK, Canada and Qatar. The government from the US invested USD 5 billion to ensure 100 million doses. On the other hand, the European Commission arranged a deal that would bring 210 million doses. |

| DNA-based. | Phase 3 | 3 doses | Zydus Cadila’s vaccine, ZyCoV-D, is expected to be ready by March 2021. |

| mRNA based. | Phase 3 | 2 doses | CureVac and Bayer get associated to produce the vaccine in mass. The European Commission supported the development with €80 million. |

VIRAL VECTORS (non-replicating)

| COMPANY | CANDIDATE VACCINE | PHASE | REQUIRED DOSES | ADDITIONAL INFORMATION |

|---|---|---|---|---|

| AZD1222, based on ChAdOx1 Adenovirus. | Phase 3 | 1-2 doses | The EU reached an agreement to supply up to 400 million doses. It is the third vaccine approved for vaccination in the EU. |

| Based on Ad5 adenovirus. | Phase 3 | 1 dose | Approved in China for limited use. |

| Gam-Covid-Vac “Sputnik”. Adenovirus: Ad5 and Ad26- based. | Phase 3 | 2 doses | Approved in Russia for general vaccination. |

| Based on Ad26. | Phase 3 | 1-2 doses | Johnson & Johnson paused clinical trials upon receiving an adverse event from a volunteer during a clinical trial. The US government has agreed to pay USD 1 billion for 100 million doses if the vaccine is approved. The EU reached a similar agreement for 200 million doses. |

PROTEIN-BASED VACCINES

| COMPANY | CANDIDATE VACCINE | PHASE | REQUIRED DOSES | ADDITIONAL INFORMATION |

|---|---|---|---|---|

| NVX-CoV2373: Full length recombinant SARS-COV-2 glycoprotein nanoparticle vaccine adjuvanted with Matrix M. | Phase 3 | 2 doses | The last July, government from the US arranged to pay USD 1.6 billion to expedite a coronavirus vaccine’s development. |

| Vaccine formulation with adjuvant (S protein). | Phase 1/2 | The US government dealt USD 2.1 billion to obtain 100 million doses. The EU arranged 300 million doses. Sanofi and GSK plan to produce 1 billion doses by 2021. |

INACTIVATED

| COMPANY | CANDIDATE VACCINE | PHASE | REQUIRED DOSES | ADDITIONAL INFORMATION |

|---|---|---|---|---|

| Inactivated SARS-COV-2 glycoprotein nanoparticle vaccine adjuvanted with Matrix M. | Phase 3 | Approved for limited use in the Arab Emirates. Peru volunteer in Sinopharm vaccine trial dies of COVID-19 pneumonia. |

|

| CoronaVac: Inactivated SARS-COV-2. | Phase 3 | 2 doses | Approved for general use in China. |

So, obtaining a safe and effective vaccine leads large investments to the biotechnology sector to fight the virus. The extremely high demand for SARS-COV2 vaccine doses is pushing big pharma and biotech companies to increase the efficiency in their manufacturing and scale-up processes. Moreover, workstreams that are typically sequential in a non-pandemic situation are being pursued in parallel. Companies are increasing their manufacturing capacity, transferring technology, and even starting large-scale production of candidate vaccines before they have conclusive clinical data because the economic cost of delays is so high.

In this regard, pharma and biotech development companies are already outsourcing parts of the drug development process to CMOs (Contract Manufacturing Organizations), favouring the biotechnological industry’s growth. For example, Astrazeneca transferred its vaccine production to Catalent Biologics, a viral vector production expert, to work in parallel with its main factory. This company has also signed a manufacturing agreement with Johnson & Johnson and agreed to supply the final manufacturing steps of Moderna’s vaccine. Pfizer has announced that they will delegate the scaling processes of its products to CMOs to free up its internal capacity for the COVID-19 vaccine.

Not only the developers and manufacturers of COVID-19 vaccine are receiving the major investments, but also those companies involved in the development of antiviral drugs and diagnostic tests for SARS-Cov-2. In general, companies with experience in producing in vitro tests for biomedical applications are involved in the diagnostic tests. We can find an example in the company provider of technologies for molecular diagnostics Qiagen. The COVID-19 business segment from Qiagen includes: sample preparation kits, enzymes and own diagnostic tools and tests. In pre-COVID-19 times, Qiagen manufactured 0.45 million kits for virus extraction. Nowadays, they are producing 12 million kits, and it was expected to reach up to 20 million by the end of 2020. However, the branch of its non-COVID business (a test for the diagnosis of tuberculosis) has suffered a sales decline of 20%.

The high demand of rapid tests for early detection and treatment of COVID-19 triggered the market to an annual volume of USD 3.52 billion by the end of 2020, with an annual growth rate of 19.7% by 2021. On the other side, a growth of 7.28% in the biotechnology sector is expected with a CAGR of 8% for the period (2020-2024) worldwide.

As a counterpart, this pandemic may impede start-ups’ development and affect their opportunities to get funding. Directly related, we can see an increase in the waiting time to complete clinical trials due to the pandemic stoppage. This fact harms the financial health of small biotech companies that depend on getting results quickly to achieve successive investment rounds to get funding and survive COVID-19 situation. For instance, last March, the Swiss biotech Addex Therapeutics announced that the registration study of their leading program Dipraglurant in the treatment of Parkinson’s was postponing.

About 1,000 organisations struggled in their clinical trials as a consequence of COVID-19 restrictions. During April 2020, an 80% decrease in new patient recruitment was found compared to the same period of 2019. The clinical trials’ situation was recovered across the board to pre-COVID-19 levels in June. However, the number of clinical trials in cardiology or neurology has not been recovered yet to previous levels.

Source: https://www.nature.com/articles/d41573-020-00150-9

Have priorities in R&D changed?

Investment priorities in R&D have also been affected by the COVID-19. More economic resources are being allocated to manage the pandemic and establish new strategies to avoid potential pandemics in the future. Currently, scientific research focused on the different aspects of COVID-19 is an urgent and essential part of the WHO response. Just in the EU, €13 billion were mobilized to face the effects of the pandemic through the European Regional Development Fund (ERDF), the European Social Fund (ESF) and the Cohesion Fund (CF), of which €1.4 billion are part of the EU’s research and innovation program within the Global Response to Coronavirus launched in May 2020.

However, many opportunities related to developing new drugs against other diseases may be lost due to the funds transference prior to the study of SARS-CoV-2. A part of the government funds and resources of pharmaceutical companies dedicated to cancer therapy trials can be redirected to COVID-19 screening, testing, treatment, and vaccine studies. This could result in a slower evolution of cancer clinical trials, a delay in the completion of such studies, and therefore in the results.

Is the sector experiencing a digital revolution?

According to WHO, telehealth is the “delivery of health care services, where patients and providers are separated by distance. Telehealth uses ICT to exchange information for the diagnosis and treatment of diseases and injuries, research and evaluation, and for the continuing education of health professionals”.

Lockdown and social distancing measures adopted by the countries to control the COVID-19 pandemic have represented an innovative challenge for clinical management in Europe and at a global level. During the last year, the demand for online consultations and digital healthcare solutions has increased dramatically.

Retailers or banks had already adapted many of their processes to digital times. However, the healthcare industry has always found difficulties to achieve the digitalisation transition. Lockdown and social distancing measures adopted by countries, together with the need for hospital isolation of patients with COVID-19 and monitoring of discharged patients, have pushed for an unprecedented digital transformation in the global healthcare sector.

This has triggered an increase in the use and implementation of telemedicine tools and placed them at the forefront of current medicine. Thus, non-face-to-face consultations have skyrocketed, using emails and telephone or video calls through platforms such as Skype®, Zoom®, Microsoft Teams® or Facetime®, involving not only patients and doctors, but also connecting medical teams, healthcare workers, etc. In some countries such as Spain, Italy or the United Kingdom, the demand for teleconsultation platforms like Top Doctors has been multiplied by 30. Additionally, to secure patients’ safety and clinical trials’ integrity, the pharmaceutical industry made strides to accelerate trial innovations with digital tools and virtualization.

In the future, the main diagnoses and follow-up of chronic and asymptomatic conditions including diabetes or hypertension could be carried out digitally, leading to a considerable reduction of healthcare spending.

The European Commission’s role

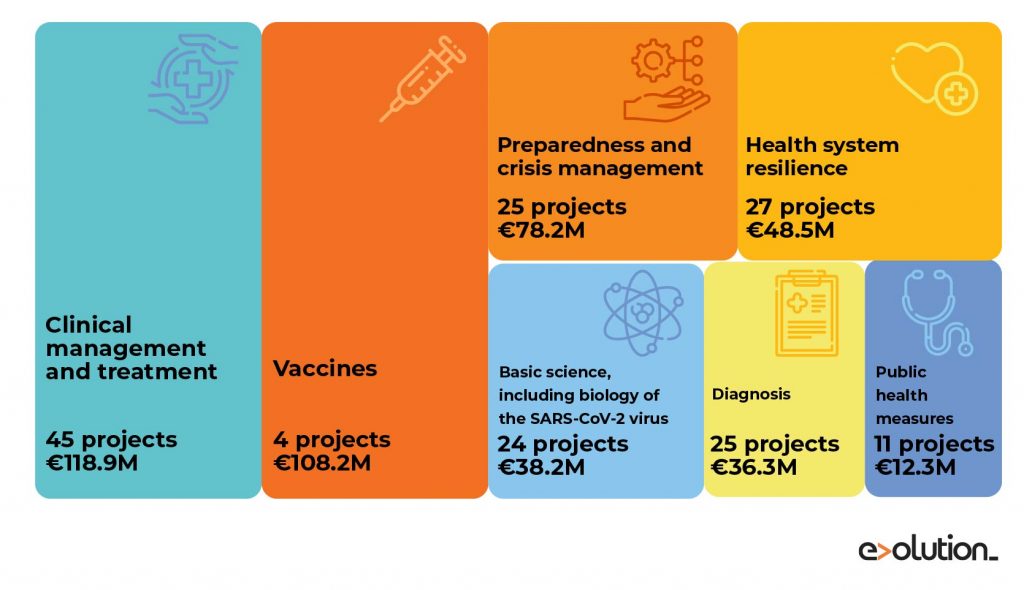

In April 2020, The European Commission and national administrations developed the first ERAvsCorona action plan, which lays out short-term research and innovation actions to tackle the virus. The EC is committed to invest more in this field, especially under the new Horizon Europe programme for R&D, to be launched during 2021. The large amount of available funds for clinical management and treatment, vaccine development and diagnostics reflects the European Union’s strong commitment against COVID-19.

Source: Distribution of COVID-19 Horizon 2020 projects according to major needs by the EU. (https://ec.europa.eu/info/sites/info/files/research_and_innovation/research_by_area/documents/ec_rtd_coronavirus-research-projects-overview.pdf)

Source: Distribution of COVID-19 Horizon 2020 projects according to major needs by the EU. (https://ec.europa.eu/info/sites/info/files/research_and_innovation/research_by_area/documents/ec_rtd_coronavirus-research-projects-overview.pdf)

The previous EU Research and Innovation programme, Horizon 2020, allocated €1 billion as part of the Commission’s €1.4 billion pledge to the Coronavirus Global Response initiative, launched in May 2020. With this support, scientists have also been able to study large groups of patients across Europe. These research actions complement earlier efforts to develop diagnostics, treatments and vaccines.

Until September 2020, the EU had invested more than €458.9 million of Horizon 2020 in more than 103 projects related to the COVID-19. These projects addressed the development of diagnostics, treatments, vaccines, epidemiology, preparedness and response to outbreaks, socioeconomics, production and digital technologies as well as the infrastructures and data resources that enable this research. Specifically, in March 2020, an extra €166 million within EIC Accelerator was available to support 36 companies with innovative solutions against COVID-19: 3 of them were focused on the development of diagnostic tests (€11.1 million), 22 on treatment solutions (€104.1 million), 5 on prevention (€32.7 million) and 6 (€17.7 million) on other aspects of the disease.

Besides, the ERC has budgeted a total of €25 million for proof-of-concept projects for new low-cost COVID-19 tests, improving clean energy production and developing drugs for treating blindness.

Thus, the European Commission funded, through the European Investment Bank, a €75 million loan agreement for the development and large-scale production of vaccines such as CureVac. Additionally, and to accelerate and scale-up the development and manufacturing of a global supply of vaccines, the Commission contributed €400 million in guarantees to support COVAX in the Coronavirus Global Response context.

Hence, the actions promoted by the European Union as well as its constant economic effort in research and innovation reflect the commitment and adaptability of the European policies in these difficult times.

The health sector is still alive!

Despite all the handicaps derived from the COVID-19 outbreak, the healthcare industry remains active and is an opportunities generator. Members of the scientific community, biotechnology and multinational companies, small and medium-sized companies can take advantage of this situation.

The European Union shows us a clear example of efficiency and versatility by managing and adapting to the adversities caused by the pandemic. The EU promotes significant support to the innovative and scientific network, transmitting a message of strength and unity.

We will have to wait a while to assess the change of the investment trends in biotechnology or digital healthcare companies. Still, we are sure that we are on the right track in terms of transforming crisis and uncertainty into opportunity and science.