R&D Tax Incentives

The General Administration of Spain offers the possibility of applying a tax deduction in the full adjusted quota, with the objective of encouraging research, development and technological innovation activities in companies.

Regardless of the result of your liquidation, your company can benefit from this incentive if it is subject to corporate taxation.

Advantages:

- They are predictable for each fiscal year.

- They are compatible with other types of financial aid (grants, refundable advances…).

- They let us:

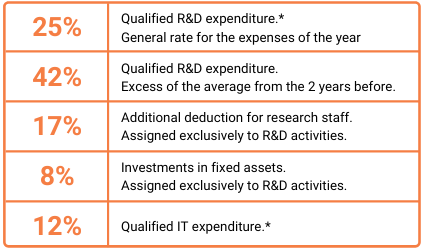

- Get back between 12 and 42% of deductible expenses.

- Get back innovation spending from up to 15 years ago.

- Keep the tax credit for the next 18 years.

- Reduce the entire fee by 50%.

- Request the return of the tax credit to the AEAT.

- They have an immediate financial effect, comparable to the subsidy.

- Absolute legal and tax guarantee.

Percentages:

The deduction percentages to be applied are the following:

* The law does not set an amount limit on the basis of deductible expense

Our process