EIC Accelerator – The Blended Finance Option

The EC has recently announced its new Accelerator Pilot Programme, which will be tested over the next year and half across the European Union and H2020 associated countries. The goal behind it: supporting European SMEs and incentivizing them to develop “at home”, so the EU can compete with the U.S.A. and Asia’s markets.

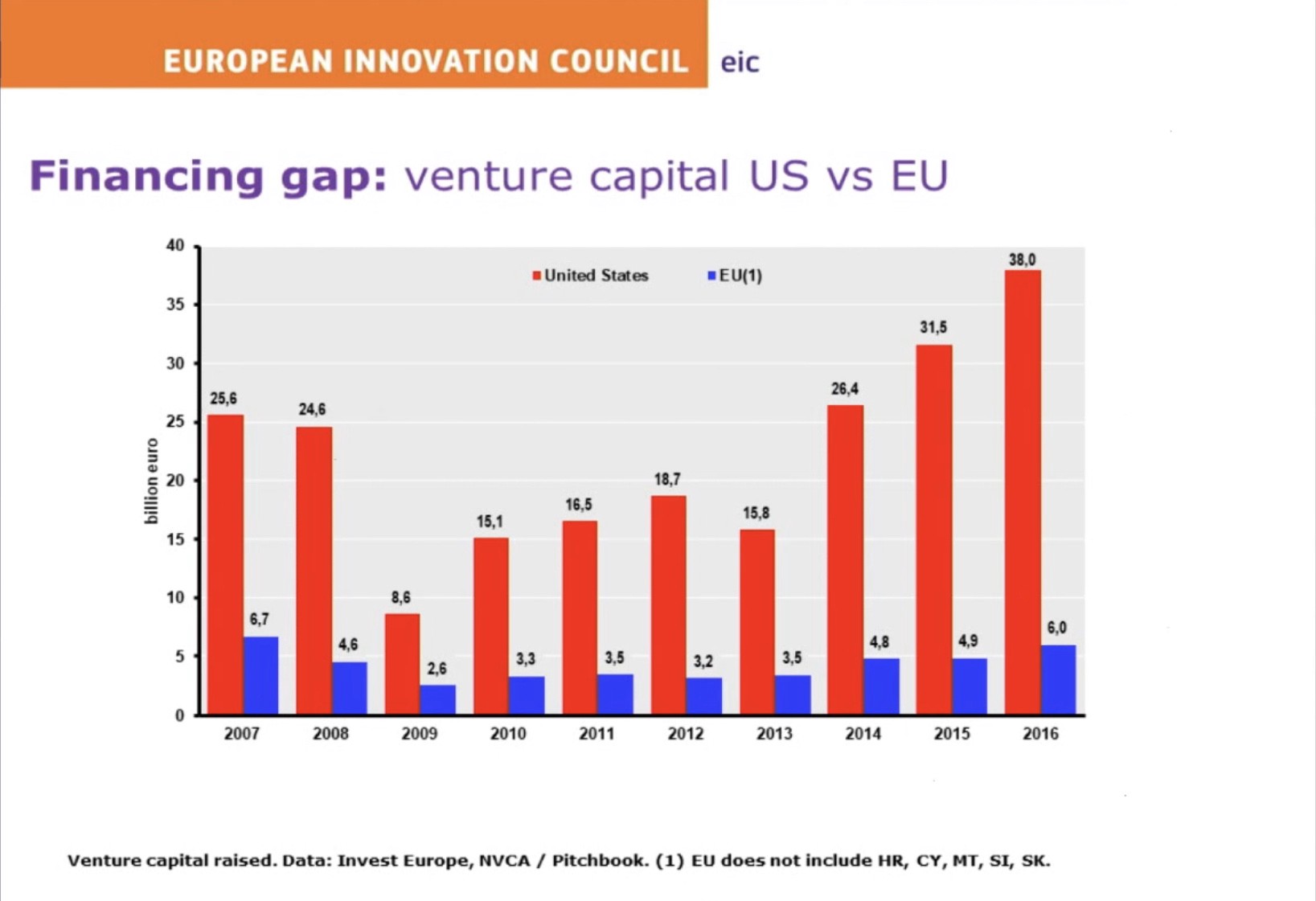

Since the global economic crisis hit in 2008, Europe’s has seen slow growth in the creation of venture capital funding compared to that of other key players on the global stage. In particular. the investment gap for companies between an early-development stage and market uptake has become an issue, largely in part due to a scarcity of private investors who are willing to support high-risk, high-tech businesses.

This financial gap, which in 2016 accounted for as much as 32 billion euros when compared to the investment available for the U.S.A, is what the EC aims to reduce. This Accelerator Pilot Programme is one pillar they will introduce to do this, via a blended finance option as part of Phase II of the SME Instrument, under the H2020 scheme.

What is blended finance?

According to the World Economic Forum’s definition, blended finance is “an approach to development finance that employs the strategic use of development finance and philanthropic funds to mobilize private capital flows to emerging and frontier markets”. (See their “How To Guide for Blended Finance” here.)

In order to stimulate investment in this area for European SMEs, the EC is proposing to include this blended finance option in its new programme to be piloted until 2020 with early-adopted companies, and hopefully later to be rolled out under Horizon Europe from 2020 onwards.

Blended finance for companies applying to the SME Instrument

Under the Horizon 2020 framework, the SME Instrument aims to support SMEs from countries all over Europe (including a list of associated countries outside the EU). Thanks to this program, non-dilutive grants of up to 2.5 million euros have been available for ambitious projects aiming to disrupt the markets through innovative products, services and business models.

The addition of blended finance as a possible option means that companies will have it in their power to choose if they want to apply for this as part of their SME Instrument Phase 2 proposal. This option of 15 million euros in equity finance will be in addition to the original 2.5 million euros that SME Instrument grants. Nevertheless, this option comes with some conditions that should be considered before submitting the proposal:

- If your company is financed under the blended finance option, an appointed representative of the EC will become a member of the board of directors as a “silent investor”, owning up to, and no more than, 25% of your company’s shares.

- This “silent investor” will be an observer, without interfering in the daily decisions of the company.

- However, the “silent investor” will look after the interest of the EC and step-in if potential risks arise, such as the company or technology being transferred out of the EU.

- If the company gives its consent, the EIC fund will actively seek private investors to buy the EC shares.

Companies applying for this option must also be aware that they will have to prove high capitalisation and operational capacity needed to match the blended finance solicited. Furthermore, they will be required to go through a financial due diligence step, involving a close analysis on the real development stage of the project to ensure they receive the correct amount of blended finance.

Are you interested in applying to the SME Instrument program? Get in touch with us through our LinkedIn post or send us an email to info@evolutioneurope.eu and we will provide you with a no-cost, no-obligation assessment of your project to determine if you would be a fit!