Social security bonus

In Spain, the Social Security Bonus for Research Personnel is a tax incentive designed to encourage the hiring and maintenance of staff dedicated to research, development or innovation. It consists of the application of a 40% bonus on business contributions to Social Security contributions for common contingencies. It is applied immediately month to month in RNT/TC2 and your request is voluntary and without deadline.

To request it, the company must meet the necessary requirements:

- Specific contracting typology

- Personnel with exclusive dedication in R&D

- Certification of the necessary process in certain cases

- Innovative SME Seal to be compatible with Tax Deductions

Innovative SME Seal – Sello Pyme Innovadora

The Innovative SME Seal is a distinction granted by the Ministry of Science, Innovation and Universities, that recognizes the research work of small and medium enterprises. It brings the following benefits:

- Reputational improvement.

- Mitigation of the risk of multi-project when certifying R&D projects.

- Benefits in the scoring of different calls for public grants.

- Compatibilization of tax deductions and Social Security bonuses for the same investigator.

Advantages of this bonus

The advantages of applying the Social Security bonus are:

- Reduction of the company’s social security quota

- Immediate and monthly application in installments

- Promotion of the hiring of research staff

- All the advantages already mentioned for being Innovative SME

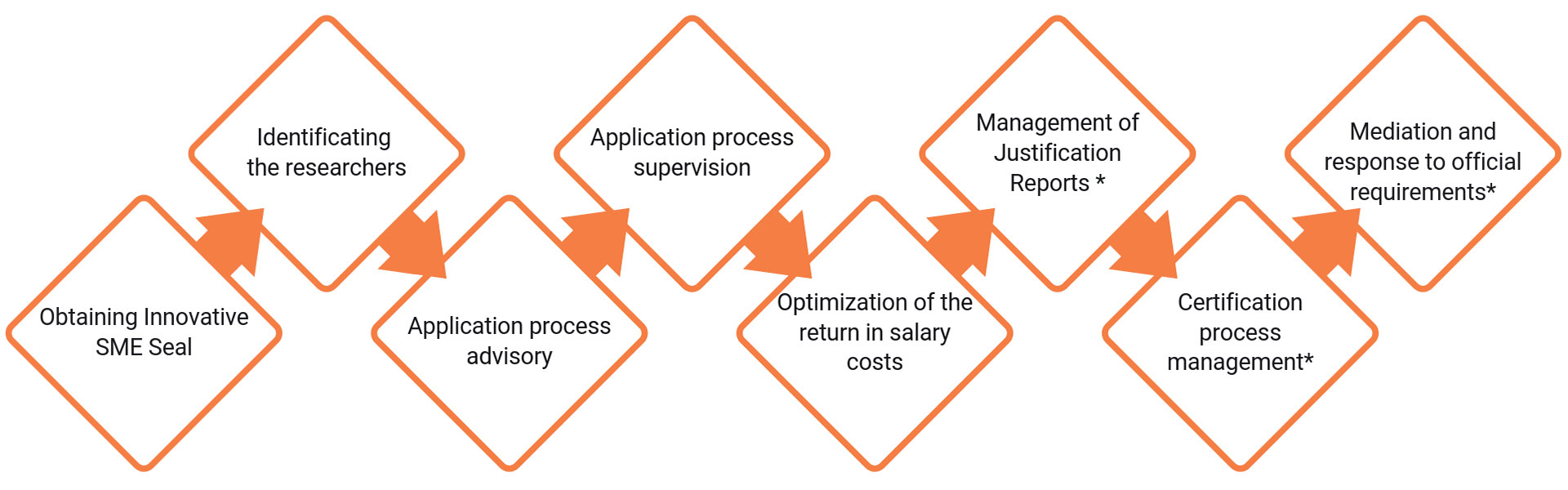

Our process