Key Insights: October 1 2025 EIC Accelerator Cut-Off Results

On 17 February 2026, the European Innovation Council (EIC) released the results of the October 1, 2025 EIC Accelerator cut-off, the final round of the year 2025. A total of 61 start-ups and SMEs were selected for funding, confirming once again the intense competitiveness of Europe’s flagship deep-tech funding programme.

1. EIC Accelerator Results for the October 2025 Cut-Off

a) Success Rate: Stricter Filtering at Full Proposal Stage

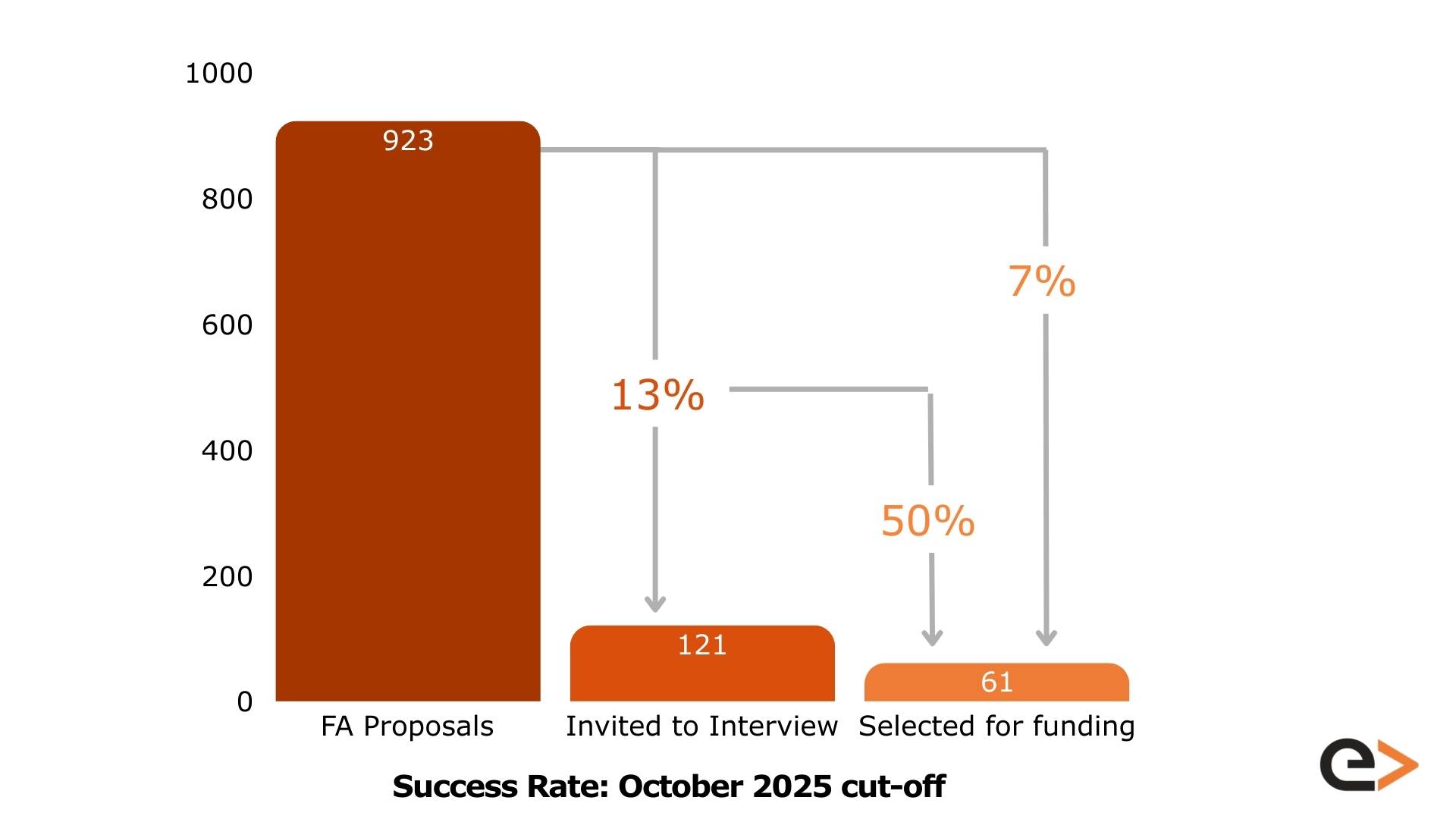

The October round recorded:

- 923 Full Applications submitted

- 121 companies invited to interview (13%)

- 61 companies selected for funding

- 7% overall success rate (Full Application → Winner)

- 50% interview success rate (Interview → Winner)

The data shows a clear shift in selectivity:

- The Full Proposal stage has become the main bottleneck, with only 13% progressing to interview.

- However, once invited to the jury stage, companies had a one-in-two chance of success.

This confirms that evaluation pressure is increasingly concentrated at the written proposal stage. Applicants must now present not only strong technological innovation, but a robust commercial strategy and investment case capable of surviving rigorous scrutiny.

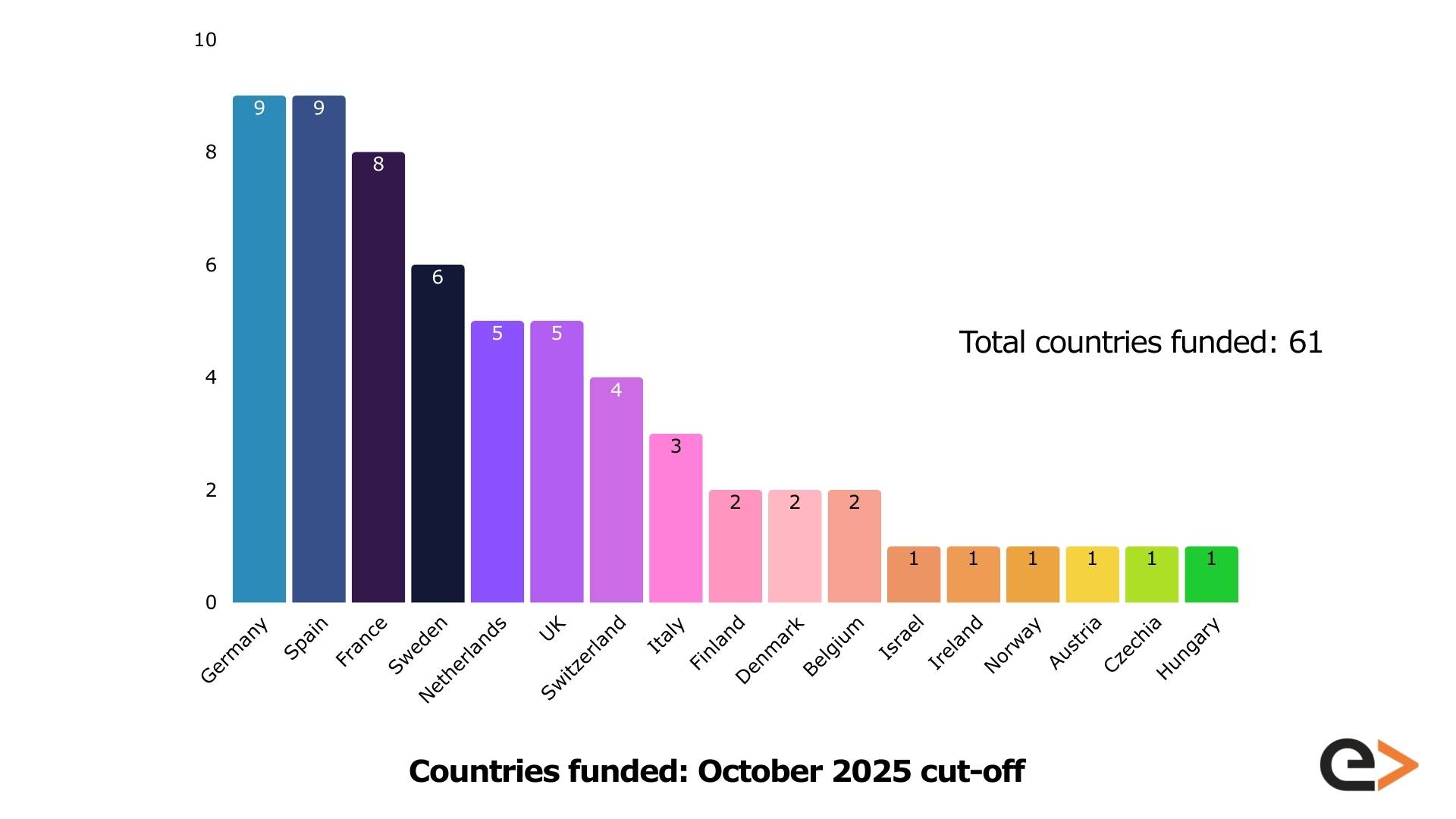

b) Countries: Germany and Spain Lead

The 61 selected companies come from 17 countries, demonstrating broad geographic representation across the European innovation ecosystem.

Germany and Spain led the round, while France maintained a strong presence. Switzerland’s results reflect its renewed participation in Horizon Europe. The Nordic countries and the Netherlands also continue to perform consistently.

2. Meet the Winners

Sectors Funded

The October 2025 cohort highlights Europe’s strength in deep-tech innovation, spanning:

- Climate and energy technologies

- Quantum and semiconductor innovation

- Advanced materials and manufacturing

- AI and digital infrastructure

- Medtech and biotech

- Space and robotics

Full List of selected companies / winners

Below is the full list of selected companies:

| Company | Acronym | Description | Country |

| Ensemo GmbH | SeedJection | Enabling technology for microorganisms in agriculture | Austria |

| MAGICS TECHNOLOGIES | HEROS | High-reliability European semiconductor chips | Belgium |

| SOLHYD | Solhyd | Industrial solar hydrogen modules | Belgium |

| Neutrality | DEEP-SEC | Trusted cloud infrastructure foundation | Switzerland |

| Verity AG | DELTA | Drone-based edge AI learning | Switzerland |

| PREGNOLIA AG | Pregnolia Dx | Precision device to predict preterm birth | Switzerland |

| DePoly | R-PURE | Advanced plastic recycling purification | Switzerland |

| Zaitra s.r.o. | SKAISEN | Real-time satellite intelligence | Czech Republic |

| Assemblio GmbH | AI-APOA | AI-driven assembly optimisation | Germany |

| DeepDrive GmbH | Central Drive Unit | High-efficiency EV drive systems | Germany |

| Co-reactive GmbH | CO-REACTIVE | CO₂-to-cement materials innovation | Germany |

| DEEP Piction GmbH | Deep Piction | AI-powered whole-body imaging | Germany |

| PIXEL PHOTONICS | MULTIWAVE | Superconducting photon detection | Germany |

| ivilion GmbH | NEXTPACK | Advanced EV battery cooling systems | Germany |

| RAYDIAX GmbH | RAYDIAX TACT | Oncology imaging innovation | Germany |

| HeyCharge GmbH | SecureChargeFLEX | Smart EV charging systems | Germany |

| Coramaze Technologies | Tripair | Minimally invasive valve repair | Germany |

| Partisia Applications | Partisia Platform | Confidential computing platform | Denmark |

| SPARROW QUANTUM | QPAIR | Quantum photonic entanglement architecture | Denmark |

| Arkadia Aerospace | Arkadia Space | Sustainable space propulsion | Spain |

| Bisari Agroinnovation | Bisari | Species-specific pollen systems | Spain |

| Cramik Additive Solutions | CRAMIO | Ceramic advanced manufacturing | Spain |

| Dalan Bio | DALAN | Vaccine platform for pollinator health | Spain |

| Floatech | INSPIRE | Silicon-based battery anodes | Spain |

| IPREMOM | MaiRa | Preeclampsia diagnostic testing | Spain |

| OXOLIFE | OXO-ART | Non-hormonal fertility treatment | Spain |

| Universal Smart Cooling | SMART COOL FINS | Adaptive chip cooling solutions | Spain |

| MITIGA Solutions | SOLARA | Climate intelligence for renewables | Spain |

| Sensmet Oy | AquaSpec | Real-time liquid spectroscopy | Finland |

| Hypermine Global | Minext | Hyperspectral mining optimisation | Finland |

| NEURINNOV | ARCHE | Neurostimulation device for motor recovery | France |

| Callyope | CALLYOPECOPILOT | AI speech model for mental health | France |

| GOLANA COMPUTING | Golana PdM Suite | AI predictive maintenance | France |

| NCODIN | LUMIBRIDGE | Optical interposer for AI chips | France |

| Mecaware | ORBIS | Battery material recovery | France |

| GRAPHEAL | PFAST | Graphene PFAS water detection | France |

| SPECTRONITE | SABRE | Edge-AI spectrum automation | France |

| STEP PHARMA | STP938 | Oncology drug innovation | France |

| ECHEMICLES | Scale_eChemicles | CO₂ electrolysis decarbonisation | Hungary |

| CRANNMED | SakuraBead | Pain treatment innovation | Ireland |

| Nanovel | Nanovel | Autonomous citrus harvesting | Israel |

| Fluid Wire Robotics | DANTE | Space robotic arm | Italy |

| Involve Space | INVOLVE SPACE | Stratospheric monitoring | Italy |

| AdapTronics | SpacEAAL | Electro-adhesive space systems | Italy |

| Corbotics | Bed-Based Echo | Autonomous cardiac ultrasound | Netherlands |

| INREDA DIABETIC | DIABEACON | Automated diabetes pump | Netherlands |

| QuantaMap | NAUTILUS | Quantum chip inspection | Netherlands |

| MICROALIGN | QABLE | Optical arrays for quantum computing | Netherlands |

| WHISPP | Whispp | Assistive voice AI | Netherlands |

| NADENO NANOSCIENCE | PACAndTreat | Nanotech drug delivery | Norway |

| ArgusEye | ArgusEye | Bioprocess monitoring sensors | Sweden |

| CELLEVATE | Cellevat3d-VAX | Nanofiber vaccine scaling | Sweden |

| Celwise | CELWISE | Sustainable molded fibre | Sweden |

| ALTRIS | NASCALE | Sodium-ion battery scaling | Sweden |

| NITROCAPT | NITROCAPT SUNIFIX | Electrified fertilizer production | Sweden |

| Westra Materials | ODIN | Organic battery materials | Sweden |

| Adaptavate | Breathaboard | Carbon-negative wallboard | United Kingdom |

| Argo Natural Resources | DEScycle | Metal recycling disruption | United Kingdom |

| EXACTMER | OPToligo | Oligonucleotide synthesis technology | United Kingdom |

| PlantSea | PlantSea | Biodegradable packaging polymer | United Kingdom |

| Cortirio | Vascascope | Stroke imaging diagnostics | United Kingdom |

3. Cumulative Perspective

2025 Overall

Across 2025:

- 1,882 Full Applications

- 271 interview invitations

- 101 funded companies

- 5% overall yearly success rate

- 37% interview-stage success rate

The data confirms that while overall success rates are tightening, interview-stage conversion remains strong — suggesting increasingly rigorous filtering before jury evaluation.

Five-Year Cumulative Data

Since the start of Horizon Europe:

- 11,873 Full Applications submitted

- 2,812 invited to interview

- 803 funded companies

- 7% cumulative success rate

This means:

- Roughly 1 in 4 applicants reaches interview

- Only 7% secure funding

The October 2025 round aligns closely with this long-term average, reinforcing the EIC Accelerator’s position as one of Europe’s most competitive innovation funding programmes.

Preparing for the Next Cut-Off

The next EIC Accelerator full proposal deadlines for 2026 are:

- 4 March 2026

- 6 May 2026

- 8 July 2026

- 2 September 2026

- 4 November 2026

Competition continues to intensify.

At Evolution Europe, we support start-ups and SMEs throughout the entire EIC process: strategic positioning, proposal development, financial modelling, and interview preparation.

👉 If you’re considering applying, now is the time to start preparing.